Rescuing the sinking ship

Egypt is in the midst of an economic and fiscal crisis. Why is the country seeking this loan from the IMF?

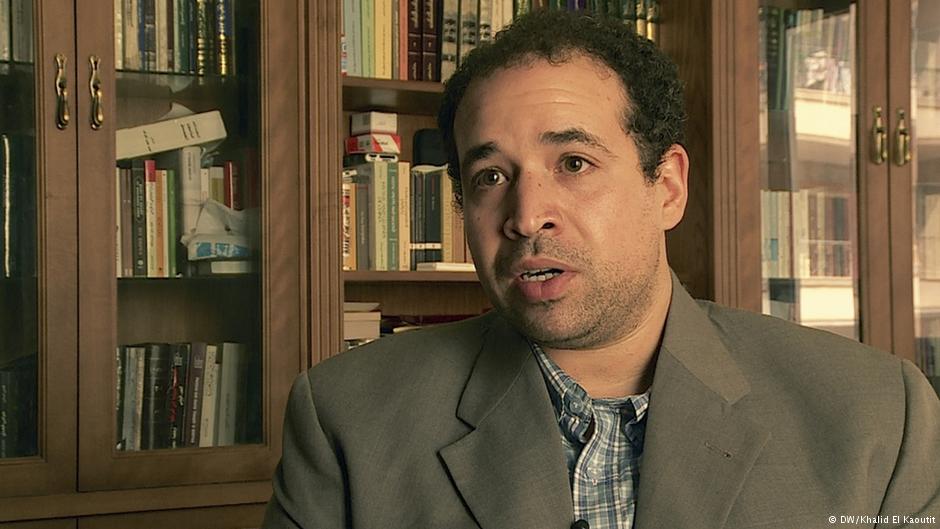

Amr Adly: Egypt′s situation is serious. The country is currently facing a deficit in both its balance of trade and its balance of payments. There is a severe lack of hard currency in Egypt, which is the main reason for the exchange rate crisis. The shortage of US dollars has put a lot of pressure on the Egyptian pound, feeding inflation – the latter fell just short of 15 percent in June 2016. This has necessarily had a negative impact on the economy. Low growth combined with high inflation is causing the economy to spiral. Although not technically in recession, the outcome so far has been a slow-down, which is why the government has tried to interrupt the process with a massive influx of foreign capital. The Scharm El-Sheikh Economic Conference, held in March 2015, was just one of Egypt′s attempts to attract investment from abroad. In sufficient quantities, this would have aided economic recovery and checked the imbalance. Now the government′s only chance of escaping this downward spiral is to borrow capital. Egypt hopes that by striking a deal with the IMF, it will be able to stabilise the economy at a macroeconomic level.

Egyptian governments reached deals with the IMF in 2011 and 2012, but the Supreme Council of the Armed Forces (SCAF) and the government of former President Mohammed Morsi never implemented these agreements. Why did the current government agree to the IMF loans?

Adly: This loan was not the only option. For political reasons, Egypt was on the receiving end of a huge amount of cash aid from the GCC countries (Gulf Cooperation Council) post-2013 – this money had no economic strings attached. But the plunge in oil prices has made it difficult for the GCC countries to continue their support for Egypt. The regional and global economies have both suffered.

That said, this aid still proved insufficient to re-structure the state budget, which is hugely in deficit. Egypt's economy today has the same problems it had in 2013. The Gulf is neither willing nor able to supply Egypt with the same level of aid anymore. This is why the United Arab Emirates extended Egypt's quota in the IMF and paid around 1 billion US dollars in 2015 to allow Egypt to seek this massive loan. The deal between Egypt and the International Monetary Fund is one of the biggest loans in the organisation′s history.

Is this deal with the IMF an appropriate measure to tackle the fiscal and economic crisis?

Adly: The austerity measures and the devaluation of the pound, agreed on by the IMF and the Egyptian government, would have happened anyway. By implementing them in co-operation with the IMF, however, the government can make it look as if the IMF is responsible for these unpopular measures. I don′t have a problem with the IMF deal per se. What I am concerned about is the massive borrowing of money. This will raise Egypt's external debts by 40 percent, which is hugely risky. My main concern is that the government will not invest these loans, but use them to cover expenses instead. There will be no return. Indeed I fear that the Egyptian economy will not be able to pay off these debts.

The government says it will stabilise foreign exchange mechanisms and attract foreign investment. But in an ailing global economy, that′s easier said than done. If they fail to trigger an increase in economic growth, these austerity measures will lead to lower standards of living for the majority of the population. It′s a risk the government is willing to take simply because there is a lack of options.

And yet, on the other hand, the government is trying hard to pretend that all these austerity measures are not related to the IMF deal at all. Why?

Adly: It′s the usual kind of government propaganda. The political leadership is committed to reform and to implementing these austerity measures. They have been preparing to go in this direction for a while and are willing and able to implement them. In 2014, for instance, the government reduced the subsidies for fuel significantly, but got nothing in return. So the subsidy cuts were frozen. They are not going to proceed without getting something back. As the aid from the Gulf continued to shrink, however, they had to act. The conditionality on IMF programmes is a restraint.[embed:render:embedded:node:19060]

The government and Egypt's President Abdul Fattah al-Sisi announced that they will implement a new system that provides subsidies only for those in need. What will this new system look like?

Adly: This is not yet clear. What might happen is a slash in fuel subsidies and an introduction of cash transfers for the poorer segments of society. They might end up mixing both measures and extend the smart card system that was introduced in 2014. The idea is to distribute smart cards for car owners with a certain quota for subsidised fuel. If customers purchase fuel beyond their quota, they have to pay a higher price.

Egyptian syndicates fear a mass sacking of state employees. Some are saying up to 2 million people might lose their jobs as a result of the controversial Civil Service Act. Is this realistic?

Adly: These figures are nonsense. The Civil Service Act was watered down considerably in the latest draft. What they want to do is encourage people to leave. The government wants to bring down the wage bill that has increased vastly since 2011 and limit the percentage of the state budget that is spent on wages. The wage bill increase has been even higher than inflation.

Six syndicates have rejected the VAT tax the government wants to implement in Egypt. In a statement, the syndicates stated that this tax ″will serve to further impoverish the poor″. They expect that the tax ″will result in increased incidents of tax evasion."

Adly: I doubt this. There is little room for tax evasion. There are a lot of VAT exemptions. It is not a flat rate. It will not impact the poor, but rather the middle classes. The middle classes, especially the lower middle class, provide the government′s bedrock of support. People who work for the state – politically it would be a risky move.

The syndicates also suggest the state should tax high income earners via a higher bracket of income tax or corporate taxes, rather than imposing VAT upon the population. Is this a reasonable way to deal with the budget deficit?

Adly: I agree. There is room for more taxation in the country, especially when it comes to property. VAT is much cheaper politically, but no more so than say capital gains tax, higher taxation on incomes exceeding 1 million Egyptian pounds or a property tax. The government says it cannot tax capital. But what the cabinet could do is to tax property via income tax. This would not affect economic growth.

If tourists don′t come back to Egypt, how will the country deal with the lack of US dollars?

Adly: Structural problems exist and they are not being solved. The economy cannot work properly without this massive money influx from abroad. We are returning to the pre-revolution era of President Hosni Mubarak – the structural problems are exactly the same.

Interview conducted by Sofian Philip Naceur

© Qantara.de 2016